by ABILITY GROUP | Oct 15, 2018 | Claims, Injured Worker, Injury Management, Workers Compensation

SIRA (State Insurance Regulatory Authority) has intensified efforts to identify employer non-compliance in New South Wales, targeting businesses that fail to lodge mandatory workers’ compensation policies. Through advanced data analytics and a structured notification program, hundreds of employers have already been flagged, with penalties and premium recoveries reaching millions.

(more…)

by ABILITY GROUP | Sep 11, 2018 | Claims, Workers Compensation

Recent amendments to the Coal Industry Act 2001 (NSW) have reshaped workers’ compensation obligations for businesses operating in or around coal mining. These changes aim to improve fairness, ensure consistent coverage, and close long?standing gaps affecting contractors, labor?hire workers, and ancillary service providers. For employers, understanding these updates is essential to maintaining compliance and protecting their workforce.

(more…)

by ABILITY GROUP | Aug 17, 2018 | Workers Compensation

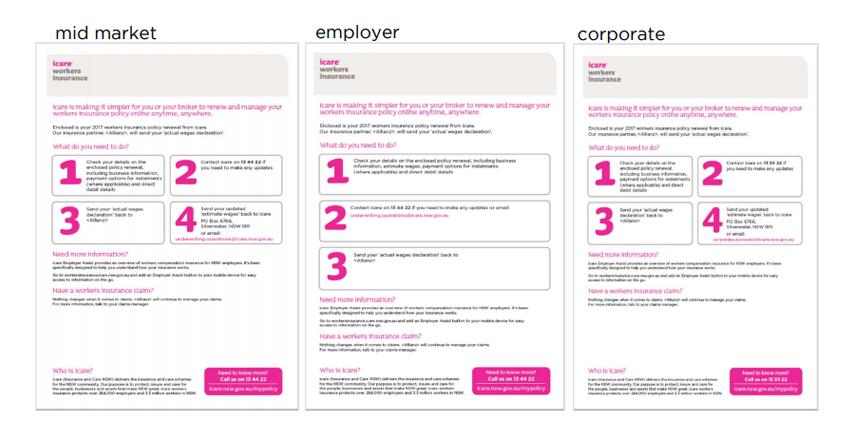

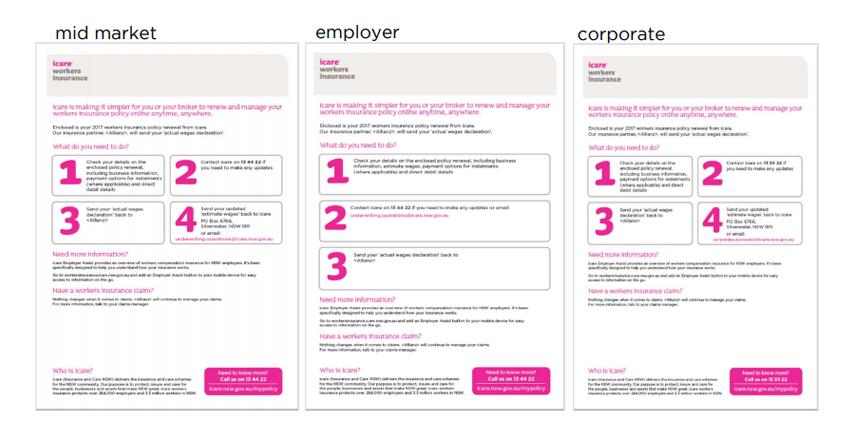

The Premium Renewal Update marks a significant step forward for ABILITY GROUP, designed to enhance customer experience, streamline subscription management, and deliver greater value to members. This update ensures that every renewal process is not only seamless but also optimised for long-term satisfaction

(more…)

by ABILITY GROUP | May 8, 2018 | Workers Compensation

The NSW Government is seeking to simplify Dispute resolution across CTP & Workers Compensation. The NSW Standing Committee on Law & Justice has commenced a review to assess the feasibility of a consolidated personal injury tribunal. .

(more…)

by Marc Ring | Mar 15, 2018 | Claim costs, Claim management, Uncategorized, Workers Compensation

ABILITY GROUP is proud to announce the March update to our New Claim Model, a significant enhancement designed to streamline processes, improve transparency, and deliver greater value to our clients. This update reflects our ongoing commitment to innovation and efficiency, ensuring that businesses can manage claims with confidence while maintaining compliance with industry standards.

(more…)

by Marc Ring | Feb 16, 2018 | Claim costs, Claim management, Claims, Reforms, Workers Compensation

The New South Wales (NSW) Claims Model has recently undergone significant changes, reshaping the way claims are managed and processed. At ABILITY GROUP, we understand that these updates can feel complex for both clients and injured workers. Our goal is to provide clarity, guidance, and support during this transition, ensuring businesses remain compliant while workers receive the assistance they need.

(more…)