Responsibilities and obligations towards employees are generally understood by most employers in NSW so that coverage is ensured in the event of a workplace accident or injury. However, less awareness is shown of how NSW Workers Compensation premiums are calculated each year and of the key factors by which the final premium payable is influenced

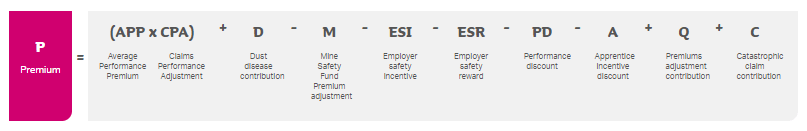

The premium calculation is based on several components which include:

- The industry/industries, Work Industry Classification (also known as WIC) in which the Insured operates

- An estimation or declared figure for the wages paid to the employees involved in each industry

The base Premium (called APP – Average Performance Premium) calculated by multiplying the wages by the WIC rate

- For any medium (APP between $30K – $500K) or large (APP $500K+) employers where their premiums are referred to as Experience Rated employers (with an APP $30K+) certain claim costs associated with your injured workers over the prior three years will also impact premium calculations

- Other factors such as dust diseases levy and mine safety premium adjustment (for mining industry employers)

- Wages are central to premium calculations but often misunderstood, as workers’ compensation wages differ from payroll tax. Deemed wages can be confusing, so accurate reporting is essential. Premiums may be reduced through incentives such as ESI, ESR, PD, and Apprentice Discounts.

How often are workers’ compensation premiums calculated?

Workers compensation in business as usual situations are calculated twice during each policy period:

- The initial premium (renewal premium) is calculated at the beginning of the policy period, based on estimated wages anticipated to be paid during that period

- The final premium (Hindsight Adjustment) – is calculated at the end of the policy period based on the actual figure of wages paid throughout the Policy year.

How can employers reduce their workers compensation Premium?

Claim costs for medium and large employers are included in premium calculations for up to three years. These costs can be reduced through the implementation of the strategies noted below

- having safety practices in place to minimise the risks of accidents/injuries

- supporting Injured workers rehabilitation and RTW providing them with suitable duties and accommodating their needs and restrictions whilst they recover

Given workers compensation can be very volatile, managing your workers compensation premium can be key to a sustain business. Need help with your workers compensation premium? Contact our workers compensation specialists for help!

For further information, please refer:

Source: icare

Title: Premium calculation for experience-rated employers

Read time: 8 mins