by ABILITY GROUP | Jan 14, 2019 | Claim management, Injured Worker, Injury Management, Reforms, Workers Compensation

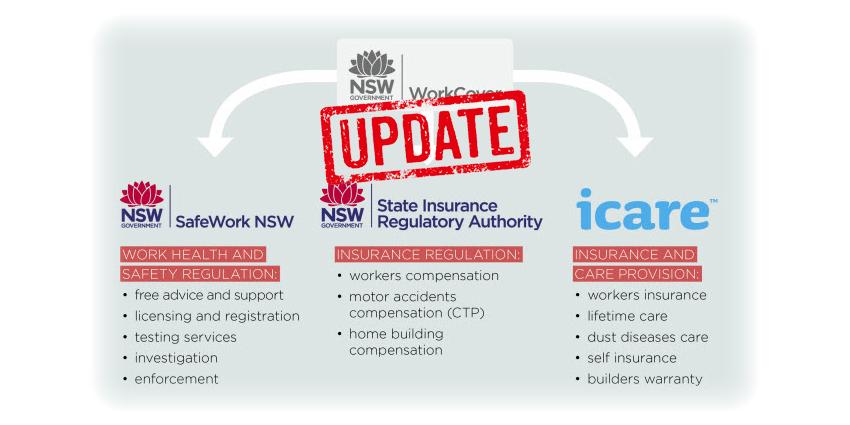

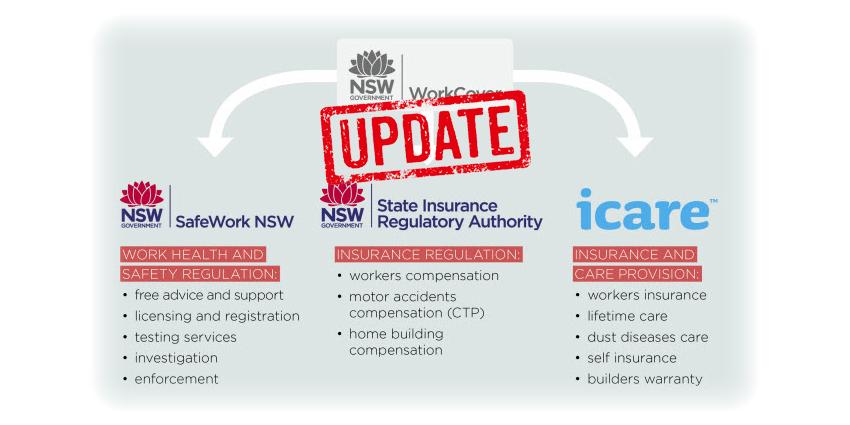

Beginning 1 January 2019, the State Insurance Regulatory Authority (SIRA) introduced reforms to the workers’ compensation dispute resolution process, aligning with the Workers Compensation Legislation Amendment Act 2018. These reforms were designed to streamline claims handling, reduce disputes, and improve support services for injured workers and employers.

Goals of the Reform

- Minimize disputes through clearer processes

- Improve efficiency in claims management

- Ensure faster responses from insurers

- Enhance transparency and accountability

- Provide stronger support services for both workers and employers

Five Key Changes Impacting Injury Management

- Centralized Dispute Resolution

- The Workers Compensation Commission (WCC) now resolves all disputes.

- Injured workers benefit from mandatory internal reviews, ensuring fairer outcomes.

- Timely Insurer Responses

- Insurers must respond within 14 days to work capacity decisions or liability reviews.

- Legal costs for workers challenging work capacity decisions are covered by Independent Legal Assistance & Review Service (ILARS).

- Improved Decision Transparency

- Notice templates must clearly identify information received from employers, workers, and insurers.

- This ensures decisions are based on complete and balanced evidence.

- Clear Complaint Pathways

- Workers’ insurer remains the first point of contact.

- Unresolved employer complaints go to SIRA (13 10 50 / contact@sira.nsw.gov.au).

- Unresolved worker complaints go to Workers Compensation Independent Review Office (WIRO) (13 94 76 / contact@wiro.nsw.gov.au).

- Permanent Impairment Compensation

- In certain cases, the WCC can award permanent impairment compensation without referral to an Approved Medical Specialist.

Please contact us to discuss.

by ABILITY GROUP | Jan 10, 2019 | Reforms, Workers Compensation

Workers’ compensation is a cornerstone of workplace safety and employee well-being. In New South Wales, reforms introduced by the State Insurance Regulatory Authority (SIRA) in 2019 under the Workers Compensation Legislation Amendment Act 2018 have reshaped the dispute resolution process. For organisations like ABILITY GROUP, understanding these reforms is essential to managing injury claims effectively, supporting employees, and controlling insurance costs.

Why Reform Was Needed

Before the reforms, inefficiencies in claims management often led to delays in medical and rehabilitation services. These delays inflated insurance expenses, raised premiums, and negatively impacted both employers and employees. The NSW Business Chamber highlighted these shortcomings, calling for urgent changes to restore fairness and efficiency.

Key Reform Highlights

- Centralised Dispute Resolution: The Workers Compensation Commission (WCC) now handles all disputes, ensuring mandatory internal reviews for injured workers.

- Faster Insurer Responses: Insurers must respond to work capacity or liability reviews within 14 days, reducing delays in treatment and support.

- Legal Support for Workers: Costs for reviews of work capacity decisions are covered by the Independent Legal Assistance & Review Service (ILARS).

- Transparent Decision-Making: Notice templates must include information from employers, workers, and insurers, ensuring balanced evidence.

- Clear Complaint Pathways:

- Employers: unresolved complaints directed to SIRA (13 10 50 / contact@sira.nsw.gov.au).

- Workers: unresolved complaints directed to WIRO (13 94 76 / contact@wiro.nsw.gov.au).

- Permanent Impairment Compensation: In certain cases, the WCC can award compensation without referral to an Approved Medical Specialist.

Additional Adjustments

- Mandatory electronic delivery of workers’ compensation information

- Updated definition of Pre-Injury Average Weekly Earnings (PIAWE)

- Injured workers entitled to both compensation and CTP damages pay

- Certain entitlements may now be commuted

Positive Outcomes

Despite initial criticism, the NSW Treasurer’s office has emphasized the reforms’ success. Since 2015, they report:

- Reduced business premiums

- Increased worker support

- Elimination of scheme debt

- Correction of the predicted $4.1 billion deficit and prevention of 28% premium hikes

Impact on ABILITY GROUP

For ABILITY GROUP, these reforms mean:

- Lower insurance costs through streamlined claims management

- Faster recovery support for injured employees

- Improved compliance with updated legislation

- Enhanced reputation as a fair and responsible employer

Conclusion

The state of workers’ compensation reform in NSW reflects a significant step toward efficiency, fairness, and sustainability. By embracing these changes, ABILITY GROUP strengthens its injury management processes, supports its workforce more effectively, and positions itself as a leader in responsible business practices.

Contact us to know more

Source: Insurance News

Title: NSW Treasurer hits back after workers’ comp criticism

Read time: 2 minutes

by ABILITY GROUP | Nov 19, 2018 | Human Resources

As of 1 November 2018, the Fair Work Commission introduced changes across a large number of modern awards. While many of these adjustments were largely wording-related and did not alter the intent of clauses, several key changes directly impact termination of employment practices. Employers must act on these updates to remain compliant and avoid penalties.

(more…)

by ABILITY GROUP | Nov 18, 2018 | Uncategorized

There are 5 common types of toxic employees. Your ability to identify & address such employees requires care to avoid complications. Knowing warning signs & understanding the difference between a difficult & toxic worker are key to minimising impacts.

(more…)

by ABILITY GROUP | Nov 13, 2018 | Health & Wellbeing, Injury Management, Mental Health

Mental illness is now recognised as the fastest-growing workplace injury worldwide, costing businesses hundreds of billions annually and impacting employee wellbeing more than traditional physical injuries. Employers who fail to address psychosocial hazards risk higher absenteeism, reduced productivity, and significant compensation claims.

(more…)