by Marc Ring | Aug 26, 2024 | Workers Compensation

The right to disconnect is a new legal provision allowing employees to refuse to engage in work-related communications outside their official working hours. This includes not having to monitor, read, or respond to emails, calls, or messages from employers or third parties unless it is unreasonable to refuse.

The right to disconnect was introduced today and applies to Australian non-small business (15+ employees) employers from August 26, 2024, and will extend to small business employers from August 26, 2025. The right to disconnect aims to help employees maintain a better work-life balance and reduce burnout.

(more…)

by Marc Ring | Jul 31, 2024 | Work Health & Safety, Workers Compensation

Earlier today, ABILITY GROUP owners Julie and Marc met with NSW Minister Sophie Cotsis to discuss workplace safety. They shared insights, highlighted challenges, proposed improvements, and explored how ABILITY GROUP can further support workers compensation and WHS.

(more…)

by Marc Ring | Jul 30, 2024 | Workers Compensation

In November 2023, the Minns Government began reviewing icare to curb waste and salary costs. The insurer is now consulting unions on changes that could cut jobs and save $23 million annually.

(more…)

by ABILITY GROUP | Jun 28, 2024 | Claims, Return To Work, Workers Compensation

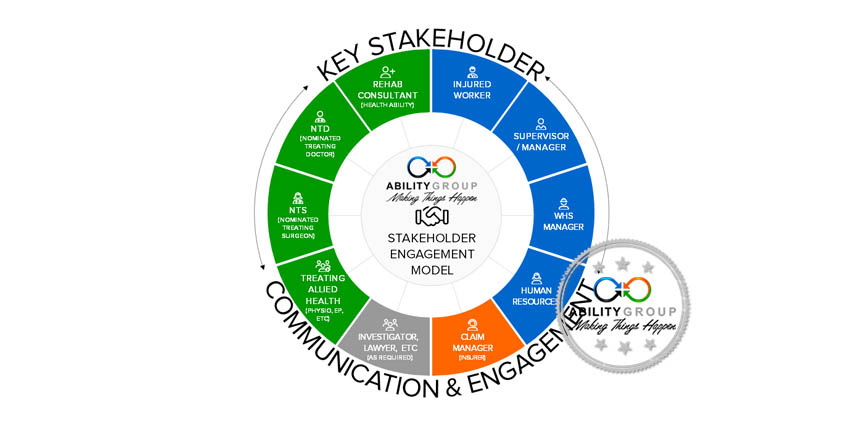

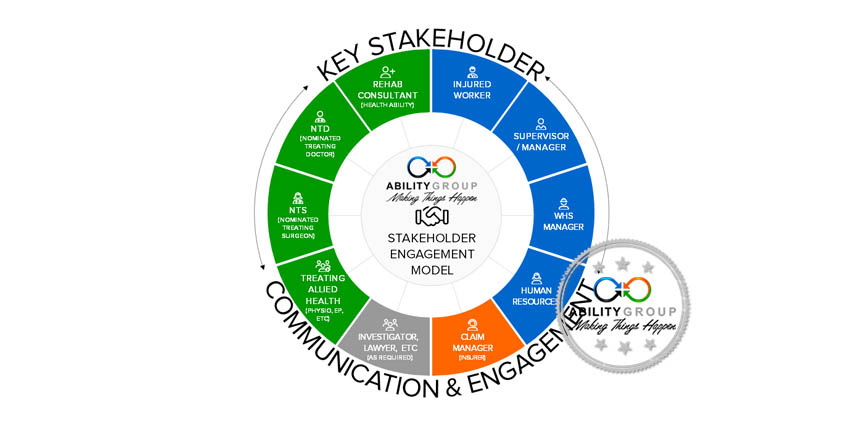

Managing stakeholders in a workplace injury claim can be complex, but each plays a vital role in the employee’s return to work.

(more…)

by Marc Ring | Jun 3, 2024 | Premium, Workers Compensation

Businesses with workers compensation insurance must declare the actual wages paid during their policy period. This declaration is essential for calculating your Adjusted Premium, which ensures you pay the correct amount and contribute fairly to the scheme.

ABILITY GROUP’s Declaring Wages Guide & Support is designed to help businesses navigate this process with confidence. Whether you’re a small business owner or managing a large workforce, understanding wage declarations is key to staying compliant and managing costs effectively.

(more…)

by Marc Ring | May 28, 2024 | Breaking News, Premium, Workers Compensation

icare confirmed today that NSW workers’ compensation premiums will increase by the maximum allowed. This represents an average of 8% as previously communicated. To curb premiums, manage injuries and claims tightly.

(more…)